Net Worth Certificate for Bank Loan

Are you looking for a Net Worth Certificate for bank loan? We provide Chartered Accountant (CA) certified Net Worth Certificates for bank and NBFC financing. Our services are fast, reliable, and available across PAN India at affordable charges. These certificates are widely accepted for bank loans, NBFC finance, government schemes, private financing, and other financial purposes. If you require a CA-certified Net Worth Certificate for your loan application, contact us now.

- Bank Loan Purpose

- Charges Rs. 3000/-

- Instant 30 Mins.

Get CA Net Worth Certificate for Bank Loan

What is Net Worth Certificate for Loan?

Are you applying for Bank Loan, NBFC Finance, Government Scheme Finance, Private Finance, Foreign Bank Finance etc? Then your banker may have asked for “Net Worth Certificate” of yours or your company/firm. Net Worth Certificate is the statement which shows the how much assets and wealth you or your company possess after deducting obligation as on particular date. In India, Chartered Accountant (CA a Member of ICAI) Issues the Net Worth Certificate for Loan and Finances.

Documents Required for Bank Loan Purpose Net Worth Certificate

To prepare a Net Worth Certificate for purposes such as bank loans, NBFC finance, government subsidy loans, overdraft (OD), or cash credit (CC) facilities, a Chartered Accountant (CA) requires the following documents, as applicable:

Identity and address proof – PAN Card, Aadhaar Card, Voter ID, etc.

Bank statements – Current and savings account statements of all banks.

Investment details – FDs, shares, mutual funds, post office savings, insurance.

Movable assets – Vehicle RCs (car, bike, etc.).

Gold and ornaments – Valuation report or purchase bills.

PPF, government bonds, and similar investments.

Immovable assets – Property ownership documents (house, land, flat, shop, etc.).

Liabilities – Details of loans from banks/NBFCs (personal, home, business, etc.).

Other monetary assets – Any other relevant financial details.

Net Worth Certificate for Loan Purpose | Charges Rs. 3000

Get a Chartered Accountant–prepared and UDIN-certified Net Worth Certificate for Bank and NBFC loan purposes for just ₹3,000/-. Our charges are fixed and all-inclusive. We serve clients across India, providing instant scanned copies and physical delivery nationwide.

How to Get Net Worth Certificate for Bank Loan Process

The process of obtaining a Net Worth Certificate from a Chartered Accountant has been made easy and simple by www.networthcertificate.com.

We are the only portal that can deliver a CA-certified Net Worth Certificate anywhere in India — in just 30 minutes.

Follow these 3 simple steps:

Step 1: Send us the required documents (checklist provided above).

Step 2: Review the draft and suggest changes, if any.

Step 3: Receive your CA-signed, UDIN-generated Net Worth Certificate for bank or financial use.

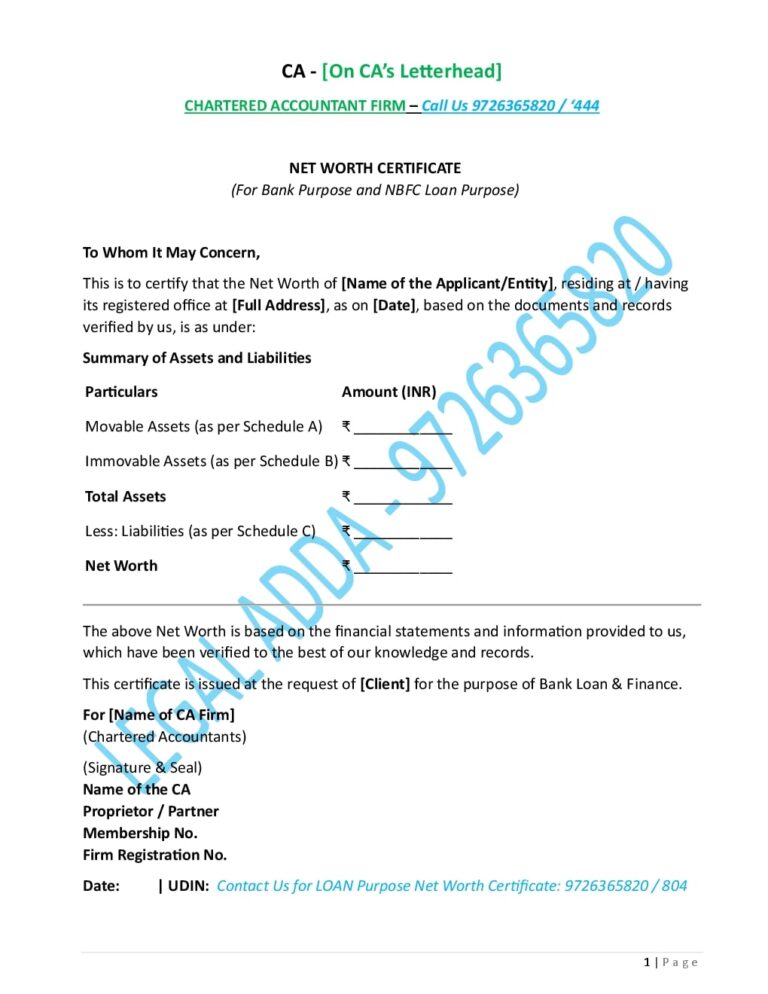

Format & Sample of Net Worth Certificate for Loan

For better understanding of the contents of a Net Worth Certificate issued for loan purposes, let’s explain it with a visual sample and format.

Why do banks require a Net Worth Certificate during the loan process?

Every bank and NBFC (Non-Banking Financial Company) follows its own rules and process for loan applications, approvals, and sanctions. As per RBI guidelines and internal bank policies, many banks ask for a CA-certified Net Worth Certificate. The main reasons for this are:

To check your financial strength

Banks use this certificate to understand how financially strong you are and whether you can repay the loan.To decide how much loan you can get

Based on your total assets minus liabilities, banks use the certificate to calculate the loan amount you are eligible for.For loans without collateral

In case of unsecured loans or loans under government schemes, banks use the Net Worth Certificate as a key document instead of asking for physical assets like property or gold.For documentation and rules

Banks and NBFCs follow strict rules. A Net Worth Certificate, signed by a Chartered Accountant, is an official document that proves your financial standing.To check the risk level

This helps banks know if lending to you is risky. If your net worth is strong, you are seen as low risk, and this may help you get better loan terms.Needed for business or large loans

For business loans, home loans, or bigger loan amounts, banks often ask for a Net Worth Certificate as a part of their approval process.

Which types of loans require a Net Worth Certificate?

Following types of loan application process requires Net Worth Certificate

Business Loans – To show company or owner’s financial strength.

Home Loans – Especially for high-value properties.

Unsecured Loans – Like personal loans without collateral.

Education Loans (High Amounts) – For studying abroad or big institutions.

Government Scheme Loans – Like Mudra or Startup loans.

NBFC Loans – Many NBFCs ask for it in their process.

Working Capital Loans – For ongoing business needs.

Project Finance – For funding large projects.

Loan Against Shares/Assets – To assess financial background.

Overdraft Facility – Based on overall net worth.

Need a Net Worth Certificate for a Loan? Get from CA Near You

If your bank, NBFC, or financing institution has asked you to submit a Net Worth Certificate for a business loan, personal loan, government scheme loan, or overdraft facility, connect with us today!

We provide CA-certified Net Worth Certificates accepted by all major banks, NBFCs, and government agencies across India.

Whether it’s for a bank loan, NBFC finance, government subsidy, or any other financial requirement, our certificates are trusted, quick, and fully compliant.

✅ Fast Delivery – Get your certificate in just 30 minutes

✅ UDIN Verified by a Chartered Accountant

✅ Fixed and Affordable Charges

✅ PAN India Service – Available in all cities, towns, and villages

📄 Service: Net Worth Certificate for Bank Loan | Business Finance | Government Schemes

📞 Contact: 9726365820 / 444

📍 Serving Locations: All over India – cities, towns, and villages included.